Inside the Pack: A Path for Topps Baseball Cards Without MLB, MLBPA Licenses

There is much we still do not know about the transition that will occur over the next few years in the hobby, with Topps losing its MLB license in favor of Fanatics. Many people continue to believe that Fanatics will either purchase Topps or license their brand name from them (beliefs that, for the record, I do not share). But recently, I got to thinking: what if Fanatics doesn’t buy Topps, and Topps still wants to make baseball cards after it loses its licenses with the MLB and MLBPA?

What makes this thought exercise interesting is that starting in 2023, Topps will no longer have a contract with the MLBPA, which means Topps cannot use current player names. However, its deal with the MLB, which allows use of team names and logos, runs through 2025, so for three years, Topps will have sort of the reverse Panini situation: no players, but team logos.

This wouldn’t and shouldn’t stop Topps from manufacturing cards in those three years. In fact, there are many ways Topps could go about producing high-quality desirable cards on the strength of its name recognition, brand awareness, and use of team logos. The MLBPA represents active players on 40-man rosters for the 30 MLB teams. While players can opt out of their group licensing program, like Barry Bonds famously did at the height of his career, it would be tough to expect Topps to convince enough players to do that to put together a set, especially given the strong-arming the union will likely give them in light of the billions of dollars the exclusive Fanatics contract is bringing in. Instead, Topps could focus on the groups that the license does not represent: namely, prospects and retired players.

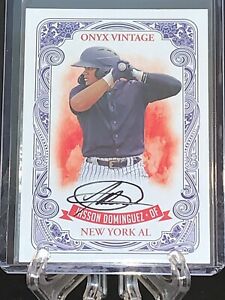

Players who have not been placed on a 40-man roster are not eligible to join the MLBPA, so the vast majority of minor leaguers, including most recent draft picks, would not be part of the group licensing and therefore not covered by the MLBPA deal. These players sign their own contracts with card manufacturers. This is what allows smaller companies like Onyx Authentics to produce cards of minor leaguers, and it’s what would allow Topps to continue making cards of prospects. Importantly, this means major products like Bowman (including Chrome, Draft, and Sapphire), Topps Heritage Minors, and Topps Pro Debut could continue almost exactly as they currently exist, using minor leaguers as well as MLB team logos in Bowman products and MiLB team logos in Heritage and Pro Debut. I don’t believe anyone would miss the MLB player portion of the Bowman products, as that product exists almost solely for prospecting.

Topps can, as it currently does, also sign individual retired players to contracts. This would mean a product like Topps Archives Signature Retired Edition could continue. High-end products like Topps Sterling, Topps Definitive, Topps Triple Threads, and so on could continue using solely retired players, and I don’t think anyone would care. Think of any retired player you can; if Topps can sign them to a contract, they’re fair game. Sure, it would stink to not have Juan Soto and Shohei Ohtani in Triple Threads, but would it be such a bad thing if it meant more Willie Mays and Babe Ruth? Topps could also bring back one of my all-time favorite product lines, Topps Retired, which used the base Topps design to create a complete set of retired players. If Topps Series 1 and Series 2 and Topps Chrome became an all-retired set with new card designs but the same large number of base cards and parallels, I think set builders and casual collectors alike would still purchase the product. Remember, they would have all-time great players, and team logos, too!

One of the most popular products, Topps Allen and Ginter, could likely continue as well. While the current iteration of the set is heavy on modern baseball players, it’s also littered with retired players, athletes from other sports, and non-sports figures as well. Decreasing the number of active players to perhaps just a few who are willing to opt out of the MLBPA deal while increasing the number of alternative subjects (and possibly including prospects) still makes the product viable. After all, a few years ago the most popular card was an egg. This year the hot card is rookie Jaguars quarterback Trevor Lawrence, despite the card having no logo, no football pose, and no RC logo.

Beyond 2025, the situation does certainly get murky. With no MLB contract, Topps would not have the ability to use team logos at all. This means they could continue doing all of the above, but without logos, which wouldn’t be an issue for Allen and Ginter but could be a problem for all the others. Those products would not be nearly as desirable, but as Panini as shown, it’s not impossible to sell airbrushed products. Bowman would look much more like the aforementioned Onyx cards (though likely with a much better production value). Retired cards could be airbrushed, or Topps could go the route that Upper Deck took in 2012 SP Signature Edition, where cards featured no logos and no images but were simply a place for the company to use up old sticker autographs it had lying around.

Of course, all of this is conjecture and it could all be made moot if Fanatics does purchase or license the Topps brand name. But if Topps did want to forge ahead with making license-free baseball cards, there is certainly a path for them to do so.